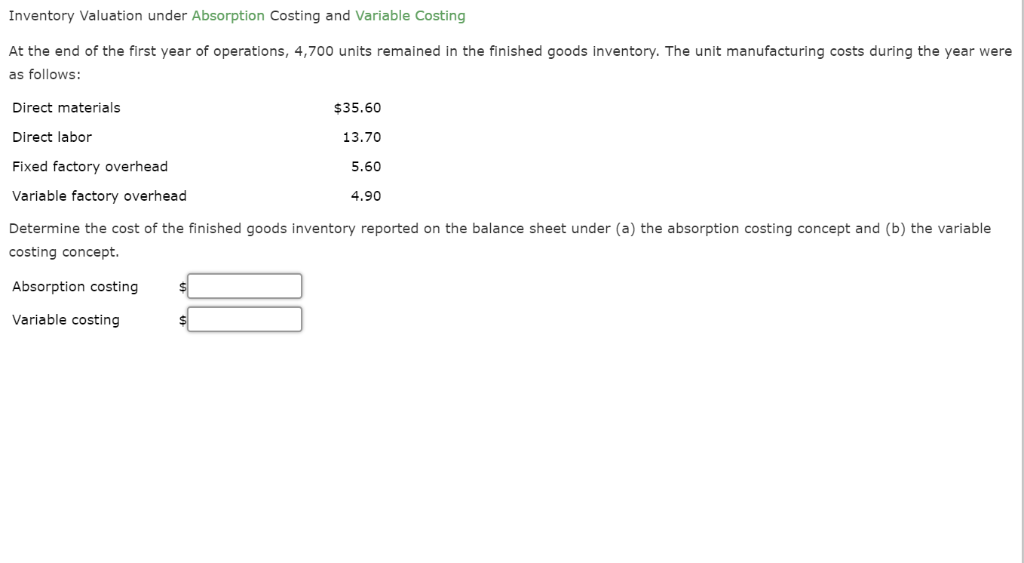

As such, a $40,000 discrepancy due to the missing transactions should be noted in the reconciliation, and an adjusting journal entry should be recorded. An investigation may determine that the company wrote a check for $20,000, which still needs to clear the bank. In this case, a $20,000 timing difference due to an outstanding check should be noted in the reconciliation. In this section, we look at some examples of accounts reconciliation to understand the scope of work involved in accounts reconciliation and the tools that can help ease the process.

- They give organizations a clear and accurate picture of their financial position, which enables them to make informed business decisions.

- For example, reconciling general ledger accounts can help maintain accuracy and would be considered account reconciliation.

- The important thing is to establish internal processes for account reconciliation and adhere to those processes.

How Precision Neuroscience streamlined systems and slashed data entry with Ramp

Today, most accounting software applications will perform much of the bank reconciliation process for you, but it’s still important to regularly review your statements for errors and discrepancies that may appear. For sales tax calculator small businesses, the main goal of reconciling your bank statement is to ensure that the recorded balance of your business and the recorded balance of the bank match up. As a result, the accounting industry has sought ways to automate a previously strenuous manual process. The pressure of SOX is coupled with the perennial need to mitigate erroneous reconciliation in the process.

What Is Reconciliation in Accounting?

When you compare the two, you can look for any discrepancies in cash flow for a certain time frame. Finally, without adequate account reconciliation processes in place, both internal and external financial statements will likely be inaccurate. Account reconciliation is a vital process that helps businesses maintain their financial health by identifying errors, preventing fraud, and ensuring the validity and accuracy of all financial statements. For example, when performing bank reconciliation, a business compares its financial statements with the records received from the bank. This helps identify timing delays in deposits, payments, fees, and interest that may have been recorded by one entity but not the other.

Business is Our Business

These practices contribute to reliable financial reporting, which is integral to almost every aspect of operating and growing a business. The primary objective of reconciliation is to identify is bookkeeping hard and resolve any discrepancies between the two sets of records. This helps preserve the integrity of financial statements and identifies errors or fraudulent activities. Account reconciliations should be performed regularly, ideally monthly, to ensure financial records are accurate and up-to-date.

How Ramp became KIPP Nashville’s biggest financial win

Such regular and timely reconciliations support financial integrity and informed decision-making. The analytics review approach can also reveal fraudulent activity or balance sheet errors. In this case, businesses estimate the amount that should be in the accounts based on previous account activity levels.

An account reconciliation is usually done for all asset, liability, and equity accounts, since their account balances may continue on for many years. It is less common to reconcile a revenue or expense account, since the account balances are flushed out at the end of each fiscal year. However, this may be done simply to verify that transactions were recorded in the correct account; a reconciliation may reveal that a transaction should be shifted into a different account. In general, reconciling bank statements can help you identify any unusual transactions that might be caused by fraud or accounting errors. Reconciling the accounts is a particularly important activity for businesses and individuals because it is an opportunity to check for fraudulent activity and to prevent financial statement errors. Reconciliation is typically done at regular intervals, such as monthly or quarterly, as part of normal accounting procedures.

For example, when reconciling your bank statement with your company’s ledger, bank reconciliation means comparing every transaction to make sure they match. In essence, reconciliation acts as a month-end internal control, making sure your sets of records are error-free. According to a survey conducted by the Association of Certified Fraud Examiners (ACFE), financial statement fraud constituted 9% of all reported fraud cases in 2022. This highlights the significance of accurate accounting reconciliation in detecting and preventing fraudulent activities within an organization. By reconciling financial records, such as bank statements, invoices, and receipts, businesses can identify discrepancies and irregularities and protect themselves against potential fraud. To ensure accuracy and balance, the process of account reconciliation involves comparing the balances of general ledger capital stock and surplus definition accounts with the supporting sets of data sources, such as bank statements, invoices, and receipts.